When an LLP is formed or established, it is mandatory for an LLP to recruit a certified chartered accountant. Apart from this all forms related to the audit must be submitted as required.

A LLP is a legal entity that incorporates the goodness of a partnership firm and a corporation.

In this type of partnership, the partners have limited liabilities which mean that the partners are not required to pay off the debts of the company using their personal assets and at the same time, the individual partners are not responsible for another partner’s misconduct or negligence.

An LLP is required to be registered under the Limited Liability Partnership Act, 2008.

Get a quote from Kanakkiyal in less than 24 hours.

The LLP Agreement along with any supplementary agreement, if any

PAN Card and Certificate of Incorporation of LLP

Financial Statement of LLP duly signed by the Designated Partners

DSC of all Designated Partners is required

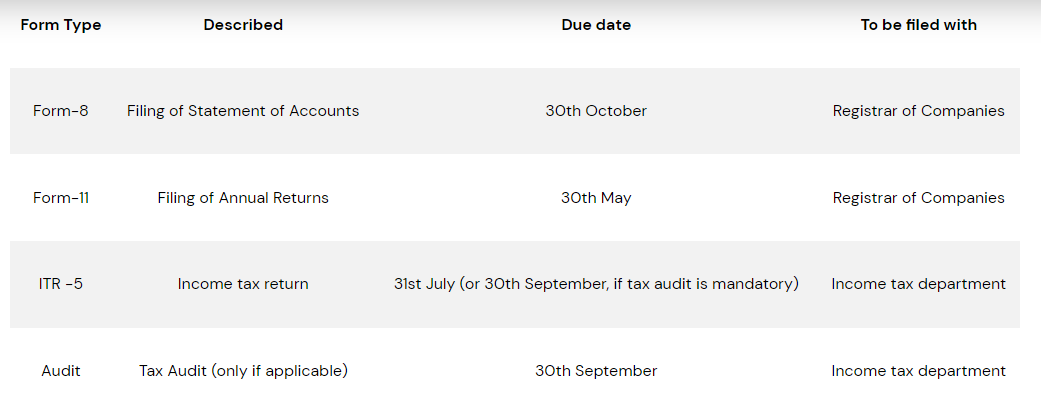

Form 11 is a statement of annual return. Every LLP is required to file Annual Return in Form 11 to the Registrar within 60 days from the closure of financial year i.e. Annual Returns have to be filed on or before 30th May every year.

Every director of a private limited company has to submit their updated residential address, current mobile number, and email address to the ROC in form DIR-3(KYC). The filing of directors KYC is mandatory for every person who holds a DIN Number, and if not complied, the DIN gets deactivated.

All LLPs must file their income tax returns on time, irrespective of their profits or losses. Even an LLP that has been inactive for a while must file the required ITR to avoid fines and other legal hassles. LLPs may file their annual IT returns via Form ITR 5. Kanakkiyal.com helps you in the filing of your ITR 5.

Form 8 is a statement of accounts. Every LLP is required to prepare and close its accounts until the 31st March every year. From 8 is to be filed by at least two Designated Partners with the Registrar within 30 days after completion of six months of Financial Year i.e. 30th October every year.

Late filing of such forms entail penalties of Rs. 100/- per day of default.

The LLP Form 8 or the statement of account and the solvency is to be filed every year by all the LLPs that are registered in India. It is filed with the MCA irrespective of the turnover.

The Partners need to comply with the annual return filing with the MCA, filing the statement of accounts.

Every LLP has to maintain uniform financial year (April to March) ending on 31st March of a year.

A digital signature is electronic signature, which is in the form of codes. It is used for signing the electronic forms, filed with ROC for incorporation of LLP Company. Digital Signature cannot be used in physical documents.

No, only private / unlisted public company can be converted into LLP.

Yes, We can conver an existing partnership firm into LLP by complying with the Provisions of clause 58 and Schedule II of the LLP Act.

When an LLP is formed or established, it is mandatory for an LLP to recruit a certified chartered accountant. Apart from this all forms related to the audit must be submitted as required.

Click the button and enter your details in the appearing form. We will contact you within 24 hours to schedule a free consultation call and discuss your needs.

Get a quote from Kanakkiyal in less than 24 hours.

An LLP is supposed to file the LLP annual return in Form 11, the financial statement of the accounts and solvency, and the income tax return.